Increased trade among 2026 shipping trends

Further growth in containerships and a rise in trade is predicted by Global Shippers Forum Director James Hookham, but disruption in the forms of tariffs, cyber-attacks and extreme weather may counter uplift. In addition, digitalisation and AI, the UN High Seas Treaty and meeting net zero by 2050 outlined by IMarEST as future maritime trends.

A continuing increase in box shipping capacity, some reduction in rates, a slight rise in trade but little progress on the IMO Net-Zero Framework are the headline predictions in shipping for 2026 shared by Hookham.

Hookham observes one major sector trend is that containerships will “continue to be ordered in numbers that far exceed the expected demand”.

“This has been the case for several years and I do not see this changing in 2026,” he says.

“Orders appear to be driven by the cost of steel and the availability of subsidies and financing terms from the shipbuilding nations rather than being anchored in foreseeable medium-term demand.

“Most new ships have been built with engines and fuel management systems capable of running on LNG or methanol as well as conventional bunker fuels and I expect this will continue as a contingency despite the setbacks to IMO [net-zero] regulations.”

On the latter, he predicts that any short-term progress towards the Net-Zero Framework will be through the “voluntary efforts of conscientious shipping lines and European Union (EU) rulemaking”.

Meanwhile, the rise of digitalisation and AI, the impact of the UN High Seas Treaty in January 2026 and meeting net zero by 2050 were highlighted by IMarEST as some of the areas the Institute will be exploring in great detail as we head into 2026.

Back to shipping, Hookham sees some positive, downwards movement in shipping rates.

“The surplus capacity should continue to exert downward pressure on container shipping rates, but carriers will continue to try their luck at stabilising them with GRIs [general rate increases] and other capacity management tactics, including blank sailings, slow steaming, skipped ports, etc.”

Global trade should stabilise and potentially increase, he says.

Trade between the United States- and China should stabilise for most of the year due to the moratorium announced in November. So, demand on the ex-China trades may even tick up if the United States tariffs are trimmed in the way reported. This trade is a major factor in the rostering of ships in the global container fleets, especially on Transpacific trades.”

Plan for the unexpected

However, Mr Hookham also notes that any predictions for 2026 risk being upended “within the first few weeks of the year”.

“This time a year ago, many shippers’ biggest concern was the impact on their United States sales [through] a threatened labour dispute in East and Gulf Coast ports. Well, that was all over by week two [of 2025] and an awful lot has happened to United States trade since then.

“We’ve all been living with heightened levels of uncertainty since the Coronavirus pandemic struck. What made 2025 distinctively different though were the rapid and frequent fluctuations in demand for goods and shipping space needed to move them, as shippers reacted to the various announcements, pauses, reinstatements and eventual implementations of United States tariffs.

“Expected booking patterns vanished as United States importers rushed to beat tariff deadlines, resulting in a mini boom in Transpacific trades for carriers and a similar peak (and trough) in air cargo demand, especially ahead of withdrawal of the duty-free (or de minimis) threshold at the end of August.

“But the story is far from over as the two biggest US trading partners outside North America have yet to formally agree the full terms of a new trade agreement with the Trump administration. In addition to China, the EU is still locked in negotiations with final tariff rates for specific sectors and commodities yet to be agreed.”

Hookham notes that any tariff rates and quotas agreed would reset the trading patterns and hence core volumes that flow on the Transpacific, transatlantic and Asia-Europe trades. “And these in turn will fix the deployment and scheduling of vessels by the three alliances to serve them. We are in a holding pattern until these two mega-deals are settled,” he explains.

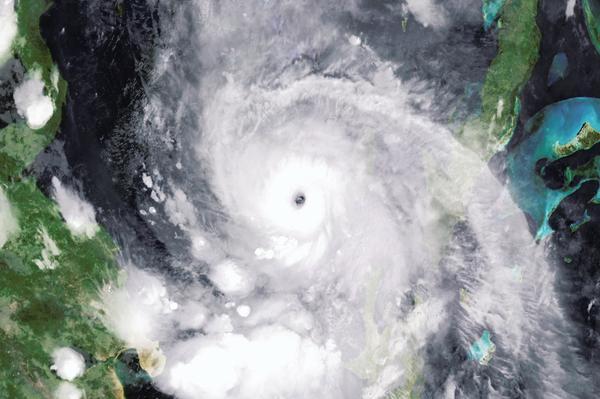

Other notable factors on the horizon in 2026 include the risk of escalation of conflicts in troubled parts of the world, the impact of ever-more extreme weather events, as witnessed with Hurricane Melissa in the Caribbean and the devastating tropical storms that swept through South East Asia recently, together with the disruptive effects of cyber-attacks, labour disputes and power outages.

“There has never been a less ‘interesting’ time to be a shipper of goods in international supply chains if you like your job to be unpredictable, chaotic and unrelenting,” Hookham jokes.

“My abiding advice for all those involved in international trade and transport is to ‘expect the unexpected’ and to invest in your capacity to change plans quickly, call in additional resources and find alternative routes to market when your ‘Plan A’ fails. From the flexibility of your sales contracts to the preparedness and adaptability of your immediate team to find and plan workarounds, supply chain resilience is a lot more than just carrying a few extra days stock in a warehouse.”

On the flipside, Hookham notes that “it might not all go badly either”.

“Most shippers would see the reopening of the Red Sea to regular navigation as a good thing and that could be an early bonus. It would cut the costs of Asia-Europe sailings by about 10% and release about 170 ships back into the already over-supplied pool of container shipping capacity,” he concludes.

Tell us what you think about this article by joining the discussion on IMarEST Connect.

Top image: Hapag Lloyd vessel leaving Miami port. Credit: Shutterstock.

Inline image: Hurricane Melissa seen from space. Credit: Shutterstock.